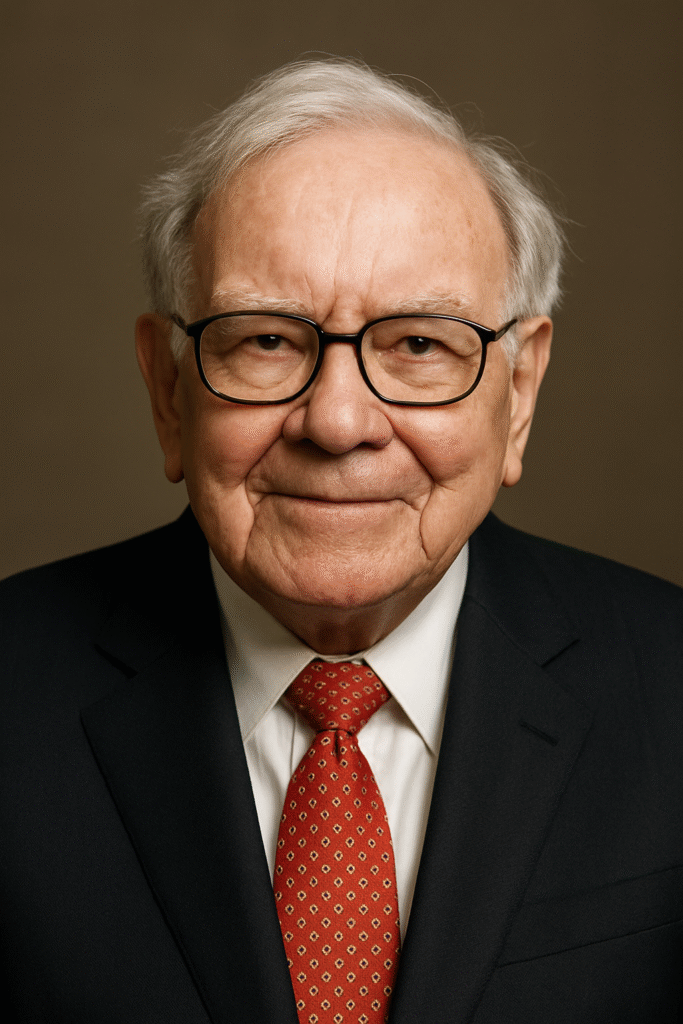

In 2025, Warren Buffett officially announced his retirement as CEO of Berkshire Hathaway, marking the end of one of the most iconic careers in financial history. At 94 years old, Buffett steps away from day-today leadership, leaving behind not only an investment track record that may never be replicated, but also a lifetime of wisdom that has shaped how millions approach money, risk, and business.

As he hands over the reins to Greg Abel—long considered the heir apparent—it\’s worth pausing to reflect

on what made Buffett’s approach so enduring, and why his advice will continue to influence generations

of investors long after his formal retirement.

A Legacy Built on Patience, Discipline, and Simplicity

When Buffett took control of Berkshire Hathaway in 1965, it was a failing textile company. Over the next

six decades, he transformed it into a global conglomerate worth over $1 trillion. A $1,000 investment in

Berkshire stock in 1965 would be worth over $30 million today. More impressively, he achieved this

without relying on exotic financial instruments, flashy tech startups, or massive leverage.

Buffett’s genius lay in his ability to combine deep business insight with discipline, long-term thinking, and

a calm temperament—even during the most turbulent markets. But unlike many in finance, Buffett didn’t

try to mystify the public. In fact, his greatest strength was clarity: distilling timeless principles into

practical guidance that anyone could understand.

Here are some of the most enduring lessons from Warren Buffett’s career:

1. Invest in What You Understand

Buffett famously avoided investments he didn’t grasp—especially in the tech sector during the dot-com

boom. While this led critics to call him “out of touch” at times, his discipline protected him from hypedriven crashes.

“Never invest in a business you cannot understand.”

This idea underpins Buffett’s focus on companies with strong brands, consistent earnings, and durable

competitive advantages—what he calls “economic moats.” Think Coca-Cola, Apple, and American

Express.

2. Be Fearful When Others Are Greedy (and Vice Versa)

Buffett has always been a contrarian investor. During the 2008 financial crisis, when panic ruled the

markets, he was buying. In fact, his 2008 op-ed in the New York Times—“Buy American. I Am.”—became

a rallying cry for rational optimism during one of the darkest financial periods in recent history.

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”

3. Time in the Market Beats Timing the Market

Buffett is not a trader. He’s a buyer of businesses. And his favorite holding period? “Forever.”

“The stock market is designed to transfer money from the Active to the Patient.”

His consistent message has been that trying to time the market is a fool’s game. Instead, he recommends

buying shares of high-quality companies—or a low-cost S&P 500 index fund—and holding them for

decades.

4. Avoid High Fees and Complexity

Buffett has long been a critic of Wall Street\’s high fees and complex products. At his annual shareholder

meetings, he’s repeatedly emphasized that most investors are better off in low-cost index funds.

“When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the

managers who reap outsized profits, not the clients.”

In fact, he famously won a 10-year bet against a hedge fund manager that a simple S&P 500 index fund

would outperform a hand-picked portfolio of hedge funds—and he won handily.

5. Character and Integrity Matter More Than Brilliance

Perhaps the most overlooked part of Buffett’s success is his deep commitment to ethical business

practices and surrounding himself with people he trusts.

“In looking for people to hire, look for three qualities: integrity, intelligence, and energy. And if they don’t

have the first, the other two will kill you.”

Buffett built Berkshire on trust—both with his partners and the companies he acquires. He often buys

companies with minimal involvement in their operations, preferring to back founders and managers he

respects.

A Humble Exit, a Timeless Influence

Unlike many CEOs who try to dominate the spotlight even after retirement, Buffett’s transition has been

quiet, thoughtful, and well-planned. Greg Abel, who has overseen Berkshire\’s non-insurance operations

for years, will now officially take the helm. Buffett has repeatedly said that Berkshire’s decentralized

model and strong bench of leaders will keep the company thriving.

As Buffett departs, his words carry more weight than ever. In an era of meme stocks, crypto speculation,

and financial noise, his simple advice continues to cut through the chaos.

He reminds us that building wealth is not about chasing the next big thing—it’s about patience, discipline, and long-term thinking.

Final Thoughts

Warren Buffett may be retiring, but the principles he’s shared over a lifetime won’t. From investing in what

you understand, to avoiding unnecessary complexity, to keeping a long-term view—Buffett’s philosophy

is simple, but not easy.

And that’s why it works.

As millions of investors continue to seek guidance in a noisy financial world, they’d be wise to revisit the

lessons of the man from Omaha. Because long after the headlines fade, Warren Buffett’s wisdom will still

be compounding.

All investments entail risk, and these risks could result in the loss of principal in your investment. There is no guarantee of returns. If there are historic or hypothetical returns identified in this piece, these are provided as informational only, and should not be read as an indication about the returns that you should expect to receive as a result of this investment. Past performance is not an indication of future results.

The guarantees associated with Annuities are subject to the financial strength of the issuing insurer and the specific terms and restrictions of the applicable policy or contract. The insurance features do not guarantee that the investment will not fluctuate in value.

The S&P 500 Index is an unmanaged market-value-weighted index of 500 stocks that measures the performance of large capitalization US stocks. The S&P 500 Index is not available for direct investment and as shown does not include any expenses or fees that would be associated in investing in a like portfolio. The S&P 500 Index does not take into account any fees or expenses that may apply to comparable investments.

Kurt Supe, John Culpepper and Brian Quick offer securities through cfd Investments, Inc., Registered Broker/Dealer, Member FINRA &SIPC, 2704 South Goyer Road, Kokomo, IN 46902, 765-453-9600. Kurt Supe, Andrew Drufke and Brian Quick offer advisory services through Creative Financial Designs, Inc., Registered Investment Adviser. Creative Financial Group is a separate and unaffiliated company. The CFD Companies do not provide legal or tax advice.