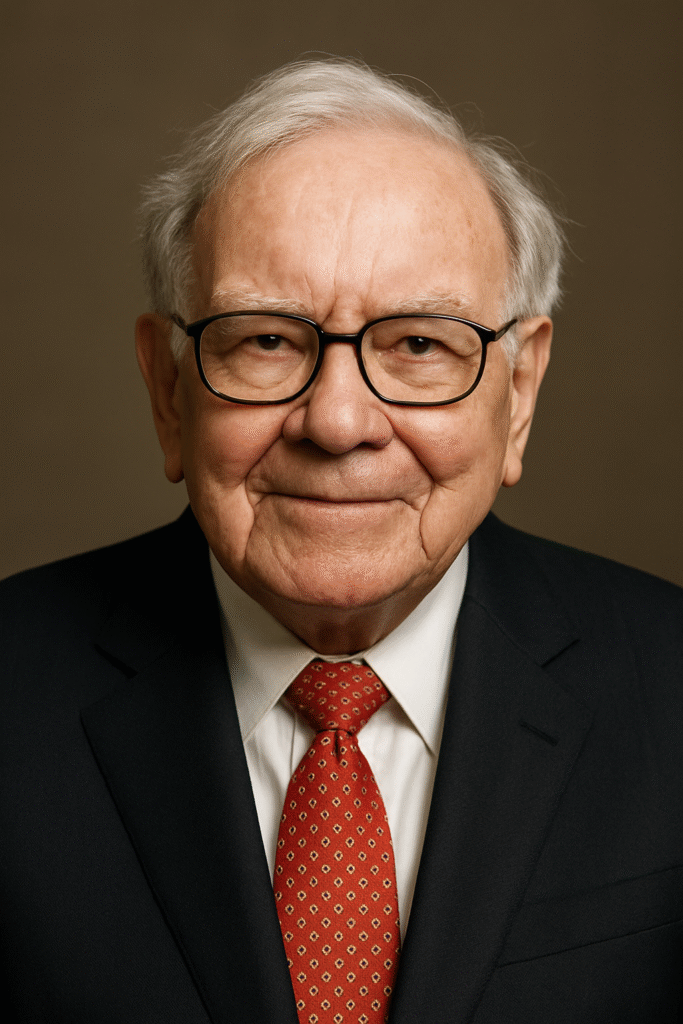

Kurt Supe became interested in the investment industry through the help of his grandmother, who assisted him in researching and purchasing blue chip stocks and then watching them grow over time. He has 20-plus years of experience in the financial services industry.

Kurt also serves as the firm’s Chief Investment Officer, overseeing the Best In Class Portfolios and managing $350 million in assets for clients. He is also still hands-on in planning for clients and supports the advisory team daily.

After graduating from the University of Kentucky with a bachelor’s degree in finance, Kurt entered the world of finance with 5/3 Bank. He quickly discovered the benefits to his clients of becoming an independent financial advisor. In 2003, Kurt partnered with John Culpepper to form the business now known as Creative Financial Group. Kurt and John are now free from sales quotas and product placements and can serve clients in the manner that best suits their individual needs and goals.

In his quest to offer his clients the best service and breadth of knowledge, Kurt obtained a license as a Certified Public Accountant (CPA). He views continuing education as instrumental to being able to provide his clients with the best financial advice and informed recommendations.

Kurt is a contributor for WIBC radio and has appeared on a number of other local media affiliates, including ABC, CBS, FOX and NBC.

Kurt is an accomplished speaker and has given presentations to many groups, including:

- INCPA (Indiana CPA Society)

- ITPA (Indiana Tax Practitioners Association)

- IACAC (Indiana Association for College Admission Counseling)

- Public and private seminars and insurance sales presentations

A resident of Indianapolis, Kurt is happily married and has two children and a dog. His family enjoys going to Kentucky Wildcat football games (where Kurt is famous for sacking Peyton Manning). He also enjoys hunting, fishing and cooking.